Introduction

Managing personal finances can feel overwhelming, but understanding and following key rules can make a significant difference in your financial well-being. Whether you are just starting your career, planning for a family, or preparing for retirement, adhering to essential principles ensures stability, growth, and peace of mind. In this article, we will explore the top personal finance rules you should follow, providing practical strategies that anyone can implement to gain control over their money.

Understand Your Financial Situation

The first step in managing finances effectively is knowing where you stand. Assessing your income, expenses, debts, and assets provides a clear picture of your current financial health. By tracking your spending habits, you can identify areas where you may be overspending and opportunities to save. Understanding your financial situation allows you to make informed decisions and set realistic goals for the future.

Calculate Your Net Worth

Knowing your net worth is a crucial aspect of financial awareness. Your net worth is calculated by subtracting liabilities, such as loans and credit card debt, from your total assets, including savings, investments, and property. Tracking your net worth over time helps you evaluate progress and make adjustments to improve financial security.

Track Your Expenses

Many people underestimate how much they spend on non-essential items. Keeping a detailed record of daily, weekly, and monthly expenses can highlight patterns and areas where adjustments can be made. Using budgeting apps or simple spreadsheets makes tracking easier and more accurate.

Build a Budget and Stick to It

Creating a budget is one of the most effective ways to manage personal finances. A budget provides structure, ensures expenses do not exceed income, and helps prioritize savings. A well-planned budget prevents impulsive spending and encourages long-term financial discipline.

Set Realistic Goals

When creating a budget, set achievable goals for saving, debt repayment, and investment. Avoid overly aggressive targets that may lead to frustration and abandoning your plan. Small, consistent progress often results in greater success over time.

Allocate Funds Wisely

Distribute your income based on priority areas, such as necessities, savings, discretionary spending, and debt repayment. A popular approach is the 50/30/20 rule, allocating 50% to needs, 30% to wants, and 20% to savings and debt. Adjust this model to fit your personal circumstances.

Establish an Emergency Fund

Unexpected expenses can disrupt financial stability, making an emergency fund essential. Setting aside three to six months’ worth of living expenses ensures you can cover emergencies like medical bills, car repairs, or job loss without accumulating debt.

Start Small and Grow Gradually

If saving a large sum seems daunting, start with smaller amounts and increase contributions over time. Even saving a modest amount each month adds up and provides financial security.

Keep Funds Accessible

Ensure your emergency savings are liquid and easily accessible, such as in a high-yield savings account. Avoid investing this money in assets with high risk or low liquidity.

Manage Debt Responsibly

Debt can be a major obstacle to financial freedom. Understanding the types of debt, their interest rates, and repayment strategies is critical for long-term stability. Prioritize paying off high-interest debt first, such as credit cards, while maintaining minimum payments on lower-interest obligations.

Avoid Unnecessary Debt

Before borrowing, evaluate whether the expense is essential and affordable. Limiting consumer debt helps reduce financial stress and frees up money for saving and investing.

Use Debt Strategically

Certain types of debt, such as mortgages or student loans, can be considered investments in your future. Manage these responsibly by making timely payments and avoiding over-borrowing.

Save and Invest for the Future

Building wealth requires both saving and investing. While saving provides security, investing allows money to grow over time through interest, dividends, and capital gains. Diversifying investments reduces risk and increases potential returns.

Start Early

The earlier you start saving and investing, the more time your money has to grow. Compound interest can significantly enhance long-term wealth accumulation. Even modest contributions early on can result in substantial growth over decades.

Diversify Investments

Avoid putting all your money into a single asset or investment type. A balanced mix of stocks, bonds, real estate, and retirement accounts spreads risk and creates multiple growth opportunities. Consider consulting a financial advisor for personalized guidance.

Plan for Retirement

Retirement planning is a crucial component of personal finance. Contributing to retirement accounts, such as 401(k)s or IRAs, ensures you can maintain your lifestyle once you stop working. Take advantage of employer matching programs and tax benefits whenever possible.

Set Retirement Goals

Determine the age at which you want to retire and the income you will need to sustain your desired lifestyle. These targets help determine how much to save and where to invest.

Monitor and Adjust

Regularly review retirement plans and adjust contributions based on income changes, market conditions, or life events. Staying proactive ensures your retirement goals remain achievable.

Protect Your Assets

Financial security isn’t just about earning and saving; it also involves protecting your assets from unexpected risks. Insurance, legal protections, and estate planning safeguard your wealth and provide peace of mind.

Obtain Adequate Insurance

Health, life, disability, and property insurance protect against financial losses. Evaluate coverage regularly to ensure it matches your current needs and life stage.

Create a Will and Estate Plan

A will ensures your assets are distributed according to your wishes. Estate planning minimizes potential disputes and tax burdens for your beneficiaries.

Maintain Financial Discipline

Discipline is the backbone of successful personal finance. Avoiding impulsive purchases, sticking to budgets, and following long-term strategies helps achieve financial stability and growth.

Automate Savings and Payments

Automating savings and bill payments reduces the temptation to spend unnecessarily. It also ensures debts are paid on time, avoiding late fees and interest.

Review and Adjust Regularly

Financial situations change over time. Periodically review your budget, investment performance, and debt obligations. Adjust strategies as needed to stay on track.

Educate Yourself Continuously

Financial literacy is a lifelong journey. Reading books, attending workshops, following reputable financial news, and consulting advisors improves decision-making and prevents costly mistakes.

Understand Financial Products

Before using financial products like loans, credit cards, or investment accounts, understand their terms, fees, and potential risks. Informed decisions prevent surprises and maximize benefits.

Stay Updated on Economic Trends

Being aware of interest rates, inflation, and market trends helps make strategic choices about spending, saving, and investing. Knowledge empowers you to adapt quickly to changing conditions.

Live Within Your Means

One of the most important personal finance rules is to spend less than you earn. Living within your means ensures consistent savings, reduces debt accumulation, and allows you to build wealth steadily over time.

Avoid Lifestyle Inflation

As income grows, resist the urge to increase spending proportionally. Maintaining a modest lifestyle while increasing savings accelerates wealth accumulation and financial security.

Focus on Value, Not Just Cost

Smart spending is not just about minimizing expenses but maximizing value. Prioritize purchases that provide long-term benefits or improve quality of life.

Following these top personal finance rules empowers you to take control of your financial future. Understanding your financial situation, budgeting wisely, managing debt, saving and investing, planning for retirement, and protecting your assets create a strong foundation for financial success. Consistent discipline and ongoing education further ensure that your money works for you, not the other way around. By implementing these strategies, you can achieve financial security, reduce stress, and enjoy life with confidence. Start today by evaluating your current finances, setting clear goals, and taking small, actionable steps toward long-term stability and growth. Take control of your money, and your future self will thank you.

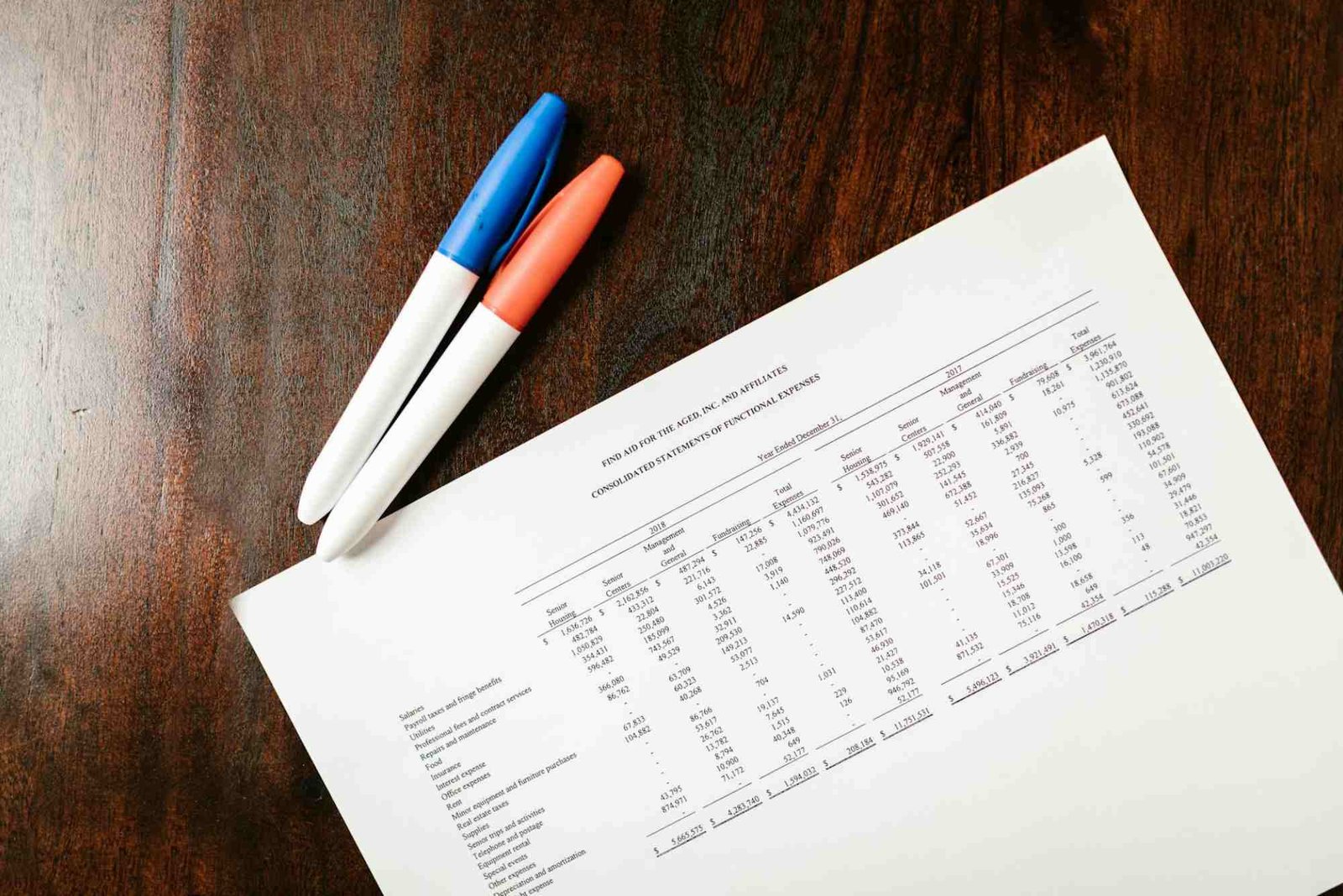

Understanding your business’s performance starts with mastering financial statements. This guide breaks down complex reports into clear, actionable insights, helping you analyze balance sheets, income statements, and cash flows with confidence. Whether you’re a beginner or refining your skills, this resource makes financial data easy to interpret and apply. Read more here: How to Read Financial Statements Easily

FAQ

What are the most important personal finance rules?

The most important rules include budgeting, saving, managing debt, investing, planning for retirement, and protecting your assets.

How much should I save each month?

Aim to save at least 20% of your income, adjusting based on your goals, expenses, and debt obligations.

What is the best way to manage debt?

Prioritize high-interest debt first, make timely payments, avoid unnecessary borrowing, and consider debt consolidation if needed.

Why is an emergency fund necessary?

An emergency fund covers unexpected expenses without relying on credit, preventing financial stress and debt accumulation.

When should I start investing?

Start as early as possible. Even small, consistent investments benefit from compound growth over time.

How can I improve my financial literacy?

Read financial books, follow credible sources, attend workshops, and consult advisors to enhance knowledge and decision-making.