Introduction

Understanding financial statements is a crucial skill for anyone involved in business, investing, or personal finance. Financial statements provide a clear view of a company’s health, profitability, and growth potential. Many people find them intimidating due to complex accounting terms, numbers, and formats. However, with the right approach, you can learn how to read financial statements easily and make informed decisions without feeling overwhelmed. This guide simplifies the process and provides practical steps for beginners and professionals alike.

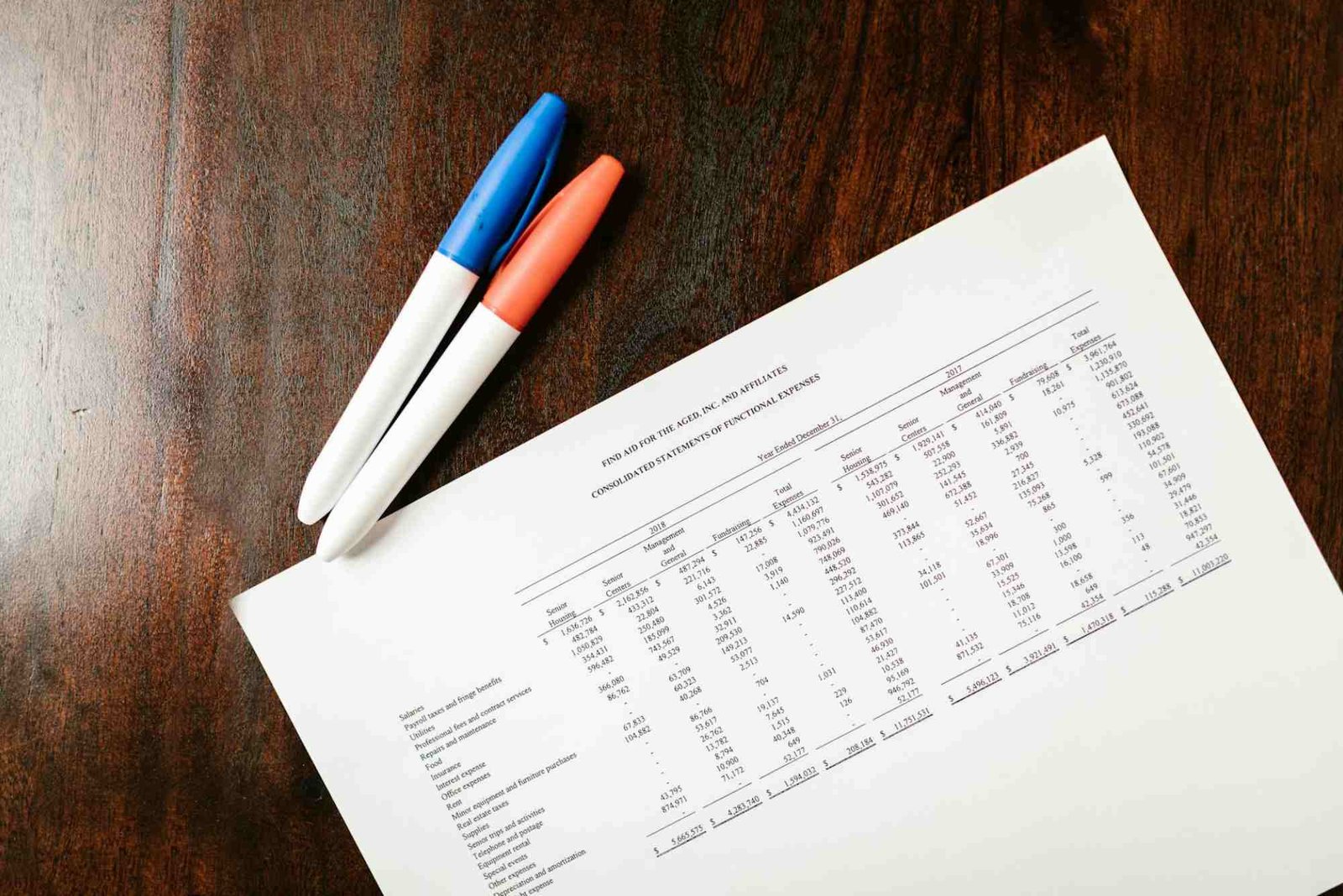

What Are Financial Statements?

Financial statements are structured reports that summarize a business’s financial activities. They provide essential information about how a company earns and spends money. The three main types are the income statement, balance sheet, and cash flow statement. Each serves a different purpose but collectively gives a complete picture of the company’s financial situation. Understanding them allows you to analyze performance, plan for the future, and make smart investment choices.

The Importance of Understanding Financial Statements

Learning how to read financial statements easily has several benefits. For business owners, it helps track revenue, expenses, and profit trends. For investors, it allows assessing the risk and growth potential of a company. Even for personal finance, understanding financial statements aids in making smarter choices when investing in stocks or managing finances. Ignoring these reports can lead to poor decisions and missed opportunities.

The Income Statement: Measuring Profitability

The income statement, also known as the profit and loss statement, shows a company’s revenue, expenses, and profit over a specific period. It is essential for understanding how well a business generates profit from its operations.

Understanding Revenue

Revenue, or sales, represents the total money earned from goods or services. It is the starting point of the income statement. When learning how to read financial statements easily, focus on trends in revenue rather than just a single number. Increasing revenue over time indicates growth, while declining revenue may signal issues in sales or market demand.

Analyzing Expenses

Expenses include all costs incurred in running the business, such as salaries, rent, utilities, and production costs. Comparing expenses to revenue helps determine efficiency. A company with high revenue but excessive expenses may struggle to remain profitable. Breaking down expenses into categories provides a clearer picture of where money is going.

Determining Net Profit

Net profit is the final figure on the income statement and represents the company’s earnings after all expenses and taxes. This number is crucial for investors and business owners because it reflects true profitability. When learning how to read financial statements easily, always check if net profit aligns with revenue and expense trends. Consistent profits indicate a stable and well-managed company.

The Balance Sheet: Assessing Financial Position

The balance sheet provides a snapshot of a company’s financial position at a specific point in time. It shows what the company owns, owes, and the shareholders’ equity. The balance sheet follows the formula: Assets = Liabilities + Equity.

Assets: What the Company Owns

Assets are resources with economic value, including cash, inventory, property, and equipment. When analyzing assets, pay attention to liquidity, which shows how quickly assets can be converted into cash. Current assets, like cash and receivables, indicate short-term financial strength. Non-current assets, such as property and equipment, represent long-term investments.

Liabilities: Understanding Obligations

Liabilities are debts and obligations the company must pay, including loans, accounts payable, and taxes. Differentiating between current liabilities (due within a year) and long-term liabilities (due after a year) is key to assessing financial stability. Companies with high long-term debt may face challenges if profits decrease, while manageable liabilities indicate stronger financial health.

Equity: Measuring Owner’s Value

Equity represents the owners’ stake in the company after deducting liabilities from assets. It shows how much shareholders would receive if the company liquidated its assets. Positive and growing equity is a sign of financial stability and investor confidence. By understanding equity trends, you can see whether profits are reinvested or distributed to owners.

The Cash Flow Statement: Tracking Cash Movement

The cash flow statement shows how cash enters and leaves the business over a period. It highlights the company’s ability to generate cash, pay debts, and fund operations. Unlike the income statement, which includes non-cash items like depreciation, the cash flow statement focuses solely on actual cash.

Operating Cash Flow

Operating cash flow reflects cash generated from core business activities. Positive operating cash flow indicates that a company can sustain its operations without relying on external funding. Negative cash flow may suggest operational problems or excessive expenses. Understanding this section is crucial when learning how to read financial statements easily.

Investing Cash Flow

Investing cash flow shows cash spent on or received from investments, such as purchasing equipment or selling assets. Large investments may reduce cash temporarily but can lead to growth in the long term. Monitoring investing cash flow helps you understand the company’s strategy and future potential.

Financing Cash Flow

Financing cash flow tracks cash related to borrowing, repaying loans, or issuing shares. Positive financing cash flow may indicate new investment or loans, while negative flow could mean repayment of debts. This section shows how the company funds its operations and growth.

Key Ratios to Simplify Analysis

Financial ratios make reading statements easier by translating raw numbers into meaningful insights. They provide quick comparisons and trends.

Profitability Ratios

Profitability ratios, like net profit margin and return on equity, show how efficiently a company generates profit. A higher margin indicates better performance and operational efficiency.

Liquidity Ratios

Liquidity ratios, such as the current ratio, reveal the company’s ability to meet short-term obligations. A strong liquidity position reduces financial risk and improves investor confidence.

Debt Ratios

Debt ratios, including debt-to-equity, assess the company’s leverage. High leverage can increase returns but also increases risk, making it essential to balance debt wisely.

Efficiency Ratios

Efficiency ratios, like inventory turnover and accounts receivable turnover, measure how effectively a company uses its assets. High efficiency indicates optimized operations and better cash flow.

Practical Tips for Beginners

Learning how to read financial statements easily requires practice and a step-by-step approach. Start by understanding one statement at a time, preferably the income statement. Use real company reports to practice analysis. Focus on trends, not just numbers, and compare them with industry benchmarks. Keep a cheat sheet of accounting terms to avoid confusion.

Consistency is key. Regularly reviewing statements enhances comprehension and allows spotting anomalies early. Avoid overcomplicating analysis with unnecessary details. Simple observations often provide the most valuable insights.

Common Mistakes to Avoid

A common mistake is ignoring cash flow and focusing solely on profits. Profits do not always equal cash, and poor cash management can lead to serious financial issues. Another mistake is comparing companies without considering industry differences. Context matters when analyzing financial statements. Relying too heavily on ratios without understanding the underlying numbers can also lead to misleading conclusions.

Take Control of Your Finances

Learning how to read financial statements easily empowers you to make informed decisions in business, investing, and personal finance. By breaking down income statements, balance sheets, and cash flow statements, and understanding key ratios, you can assess financial health with confidence. Regular practice, attention to trends, and careful analysis are essential for mastery. Take the first step today and start reviewing financial statements—it’s the key to smarter financial decisions.

Start analyzing real financial statements today and unlock the power to make informed business and investment decisions.

Best Ways to Reduce Financial Stress Financial stress can feel overwhelming, but simple strategies can help. Budgeting wisely, tracking expenses, and setting realistic financial goals are key. Building an emergency fund, reducing debt, and seeking professional advice also ease pressure. Mindful spending and planning ahead bring peace of mind and financial stability.

FAQ

How do I start reading financial statements as a beginner?

Begin with the income statement, focus on revenue, expenses, and net profit, and gradually move to balance sheets and cash flow statements.

Why are financial statements important for investors?

They provide insights into profitability, cash flow, and overall financial stability, helping investors make informed decisions.

What’s the difference between net profit and cash flow?

Net profit includes non-cash items like depreciation, while cash flow shows actual cash movement in and out of the business.

How can I identify financial problems using statements?

Look for declining revenue, rising expenses, negative cash flow, or high debt compared to equity as warning signs.

Are there tools to make reading statements easier?

Yes, accounting software, financial analysis tools, and educational platforms can help interpret statements more efficiently.